Microsoft FY23 Q1: Earnings Breakdown & AI Insights with Custom Questions using LangChain & OpenAI

Today I am going to show what I've learned from Microsoft's 2023 Q1 earnings report.

You can watch a video version:

⚠️ Disclaimer: It is educational content, for financial advice seek a professional licensed in your jurisdiction.

I described my process of fundamental analysis in a previous post.

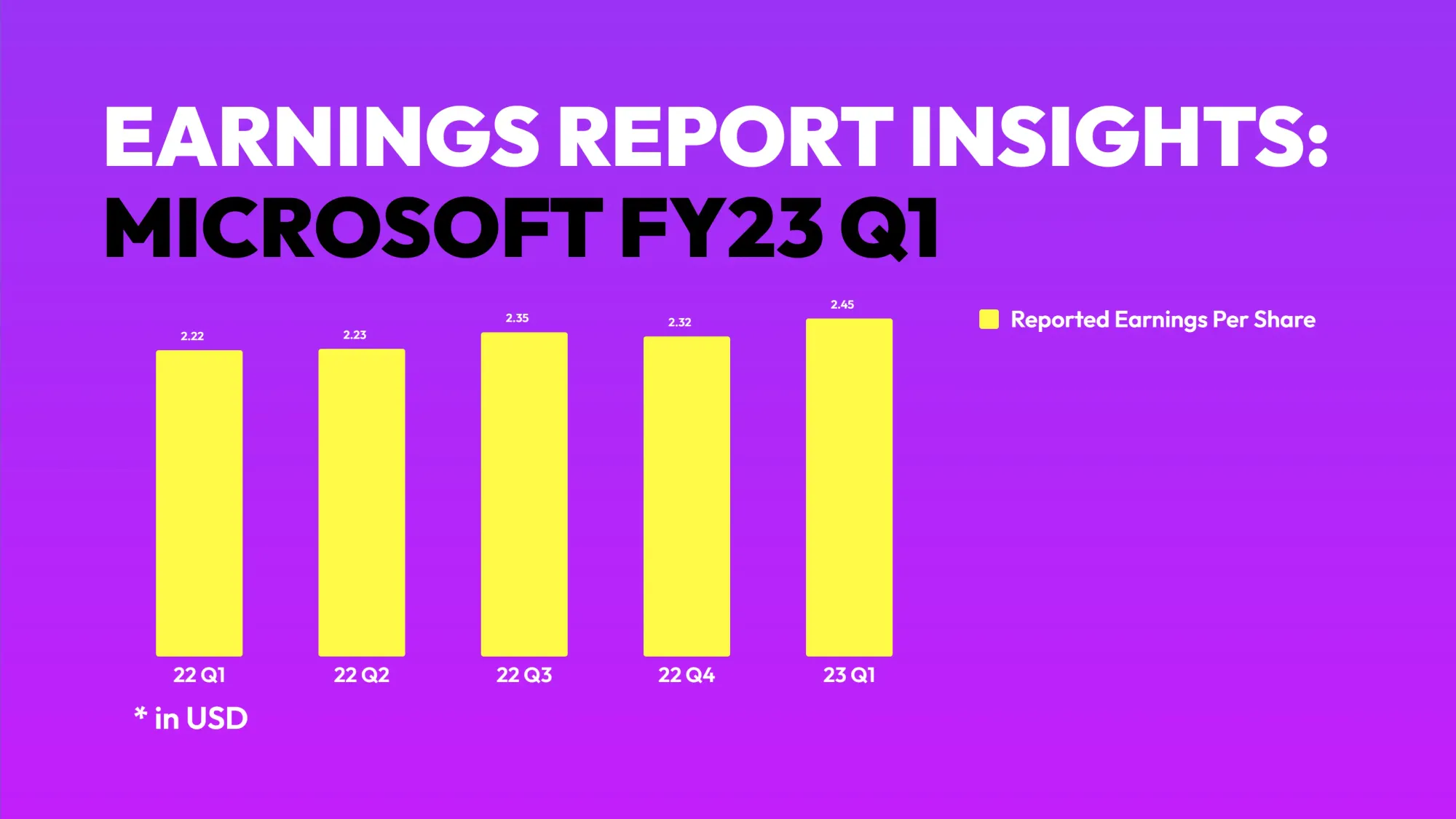

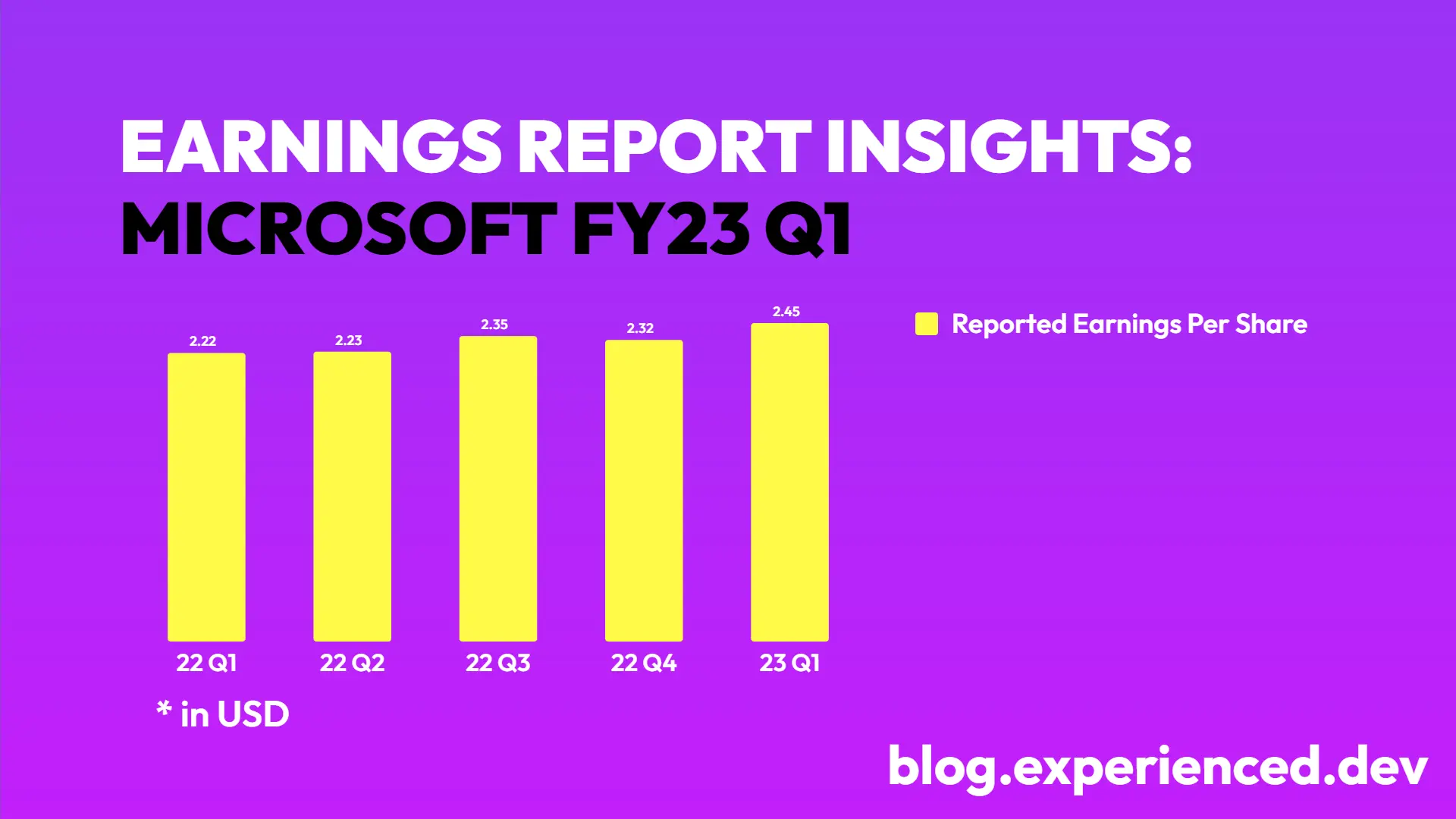

I often look at Earning Per Share metric in a dynamic. If you want to know more about EPS please read this post where I am calculating it with pandas.

Microsoft shows stable EPS.

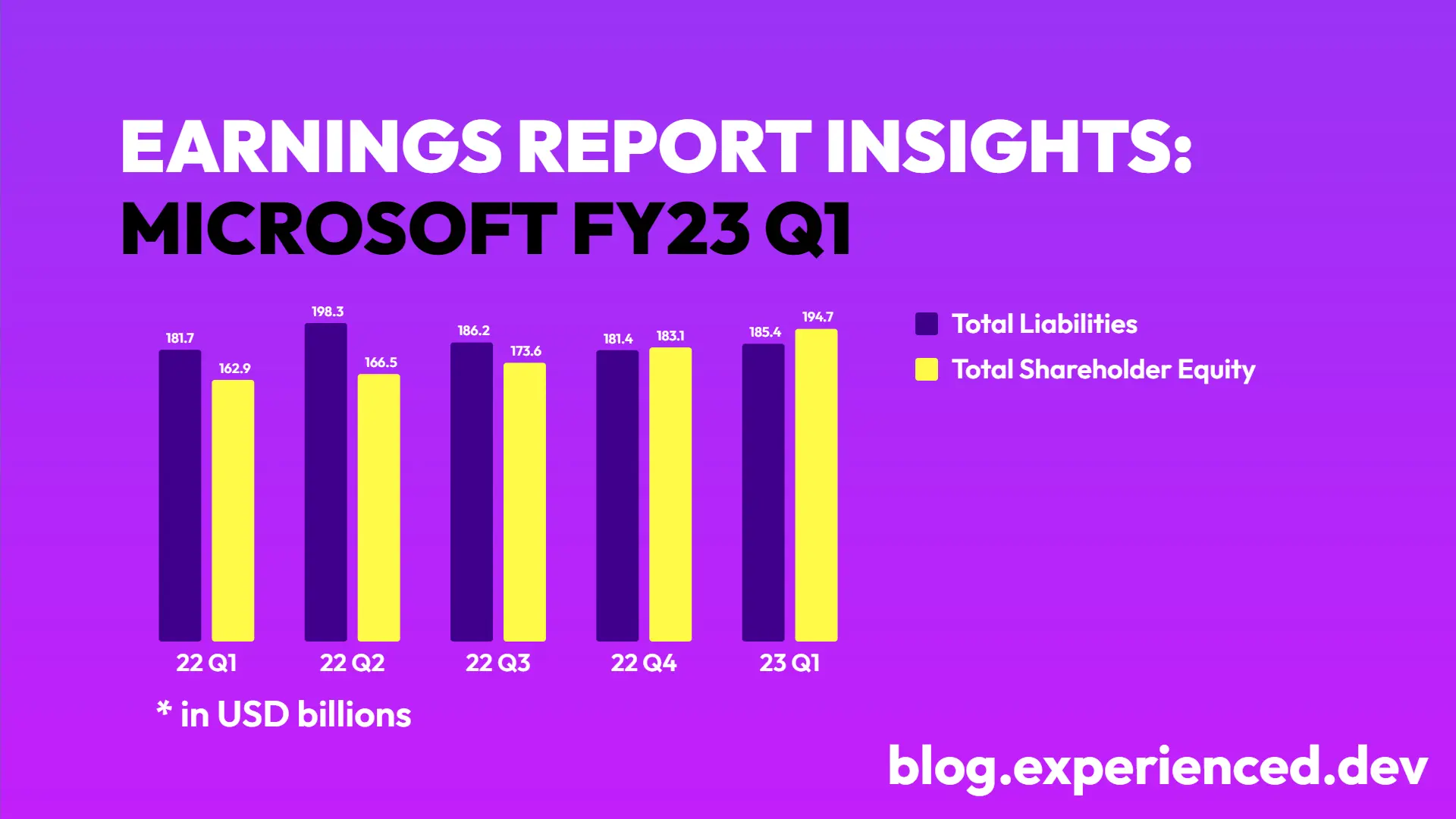

Then I review Total liabilities (what a company owes to others) and Total shareholders' equity (essentially the amount that would be returned to shareholders if all the company's assets were liquidated and all its debts repaid).

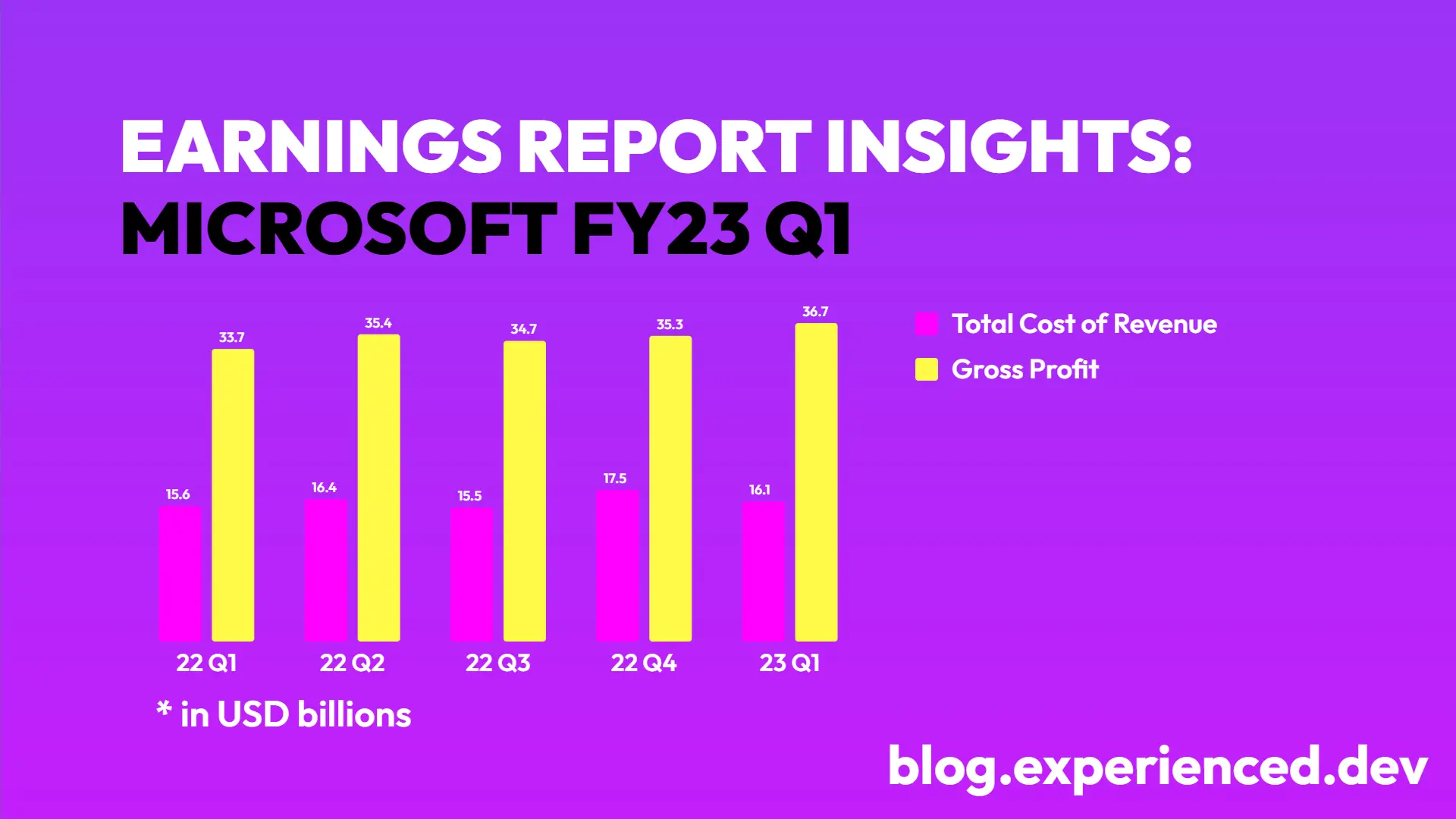

The next step in my process is to look at the Total Cost of Revenue (simply all the money a company spends to make products) and Gross Profit (left over from a company's sales after it pays for the direct costs of making products).

In general, if I am happy with the numbers from the Balance sheet, Income statement, and Statement of cash flows I would like to get insights into Management's Discussion and Analysis.

For that, I am using LangChain with OpenAI to summarize it and ask custom questions.

I open-sourced and deployed the app that I am using to HugginFace spaces.

You can summarize MD&A or ask your custom questions there.

Microsoft FY23 Q1 MD&A summary:

Microsoft reported a 7% increase in revenue for the three and nine months ended March 31, 2023 compared to the same periods in 2022. Operating income increased by 2%, driven by growth in Productivity and Business Processes and Intelligent Cloud, offset in part by a decline in More Personal Computing. Other income (expense), net, increased due to gains from changes in fair values of derivatives. The article also covers the company's liquidity and capital resources, investments, cash flows from operations, and income taxes, as well as non-GAAP financial measures, valuation of financial instruments, resolution of IRS audits, and the impact of the Tax Cuts and Jobs Act.

QA:

How Intelligent Cloud increased income?

Operating income increased $3.0 billion or 12% driven by growth in Azure and other cloud services.

How accounting estimates changed?

In July 2022, we completed an assessment of the useful lives of our server and network equipment. Due to investments in software that increased efficiencies in how we operate our server and network equipment, as well as advances in technology, we determined we should increase the estimated useful lives of both server and network equipment from four years to six years. This change in accounting estimate was effective beginning fiscal year 2023.

Note: you should double-check the answers LLM generates. Often they hallucinate.

Thank you for reading.