Earnings Report Insights: Alphabet's Q1 2023 10-Q MD&A Summary + Custom Questions with LangChain and OpenAI

Today I will show you what I've learned from Management Discussion and Analysis (MD&A) section of Alphabet's Q1 2023 10-Q form.

⚠️ Disclaimer: It is educational content, for financial advice seek a professional licensed in your jurisdiction.

If you need to know what form 10-Q is please read my previous post.

Click here if you have no idea what MD&A is.

It is a section of a company's earning report written by the company's management that provides an overview of the financial performance, risks, and expectations for the future during the most recent financial quarter.

I am looking into MD&A only if I am happy with the numbers from the balance sheet, income statement, and statement of cash flows.

My goal is to get management's narrative that can help me understand the context behind the financial results. As well as future prospects, identify potential risks, and make informed investment decisions.

Alphabet's Q1 2023 quarterly report MD&A has 13 pages. To get the full insights, you should read them all.

From my experience, it will take me 20 minutes to skim over it and look for keywords or about an hour to read it carefully.

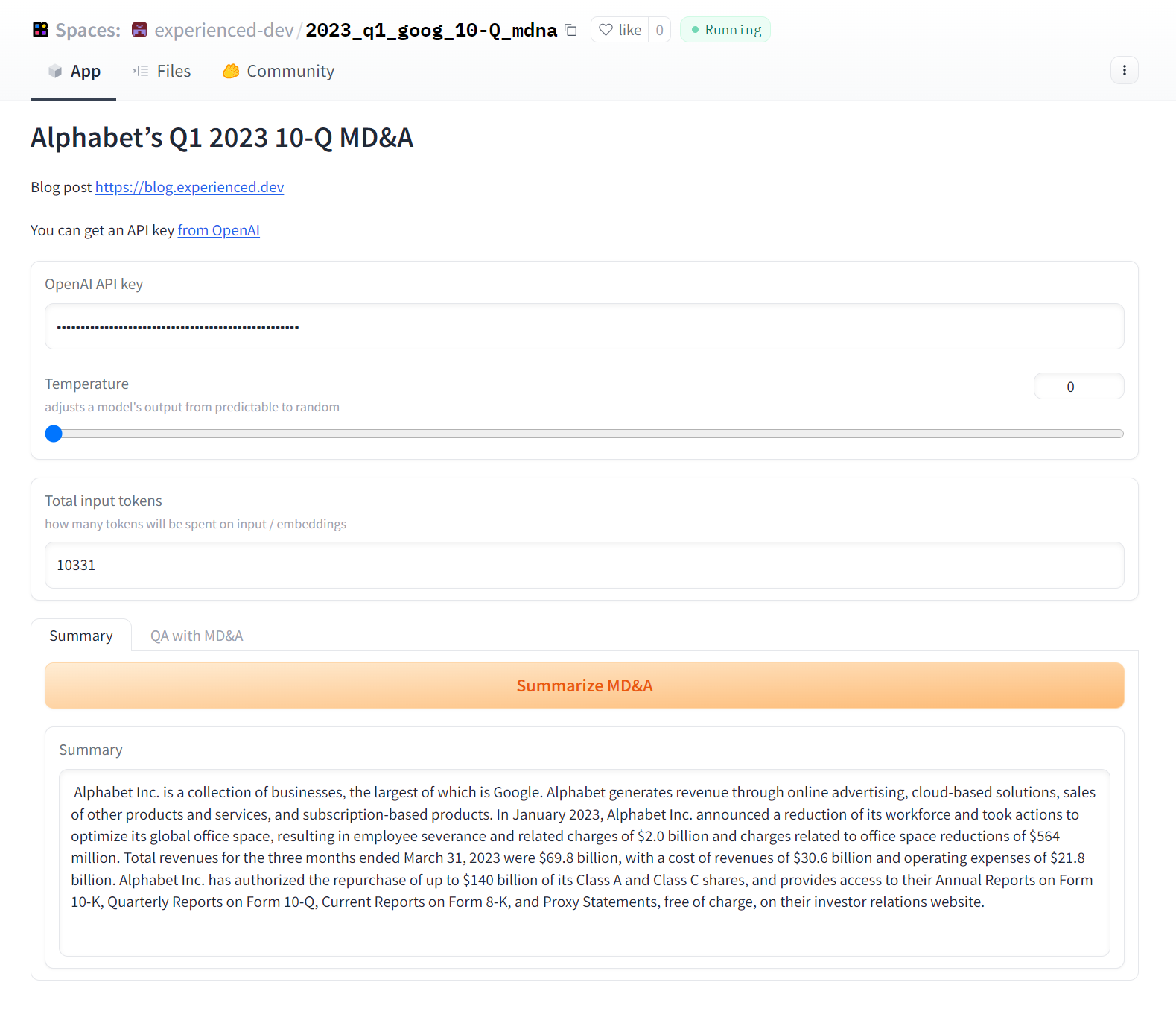

In this article, I will show you how you can summarize and ask your questions on the text from MD&A in a couple of minutes.

For that, we will use OpenAI's text-davinci-003 large language model via LangChain.

You can experiment with gradio application on huggingface space. e.g. Try different temperatures for getting more creative summaries and answers.

The application has two tabs:

The code is listed below.

Summary:

Alphabet Inc. is a collection of businesses, the largest of which is Google. Alphabet generates revenue through online advertising, cloud-based solutions, sales of other products and services, and subscription-based products. In January 2023, Alphabet Inc. announced a reduction of its workforce and took actions to optimize its global office space, resulting in employee severance and related charges of $2.0 billion and charges related to office space reductions of $564 million. Total revenues for the three months ended March 31, 2023 were $69.8 billion, with a cost of revenues of $30.6 billion and operating expenses of $21.8 billion. Alphabet Inc. has authorized the repurchase of up to $140 billion of its Class A and Class C shares, and provides access to their Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and Proxy Statements, free of charge, on their investor relations website.

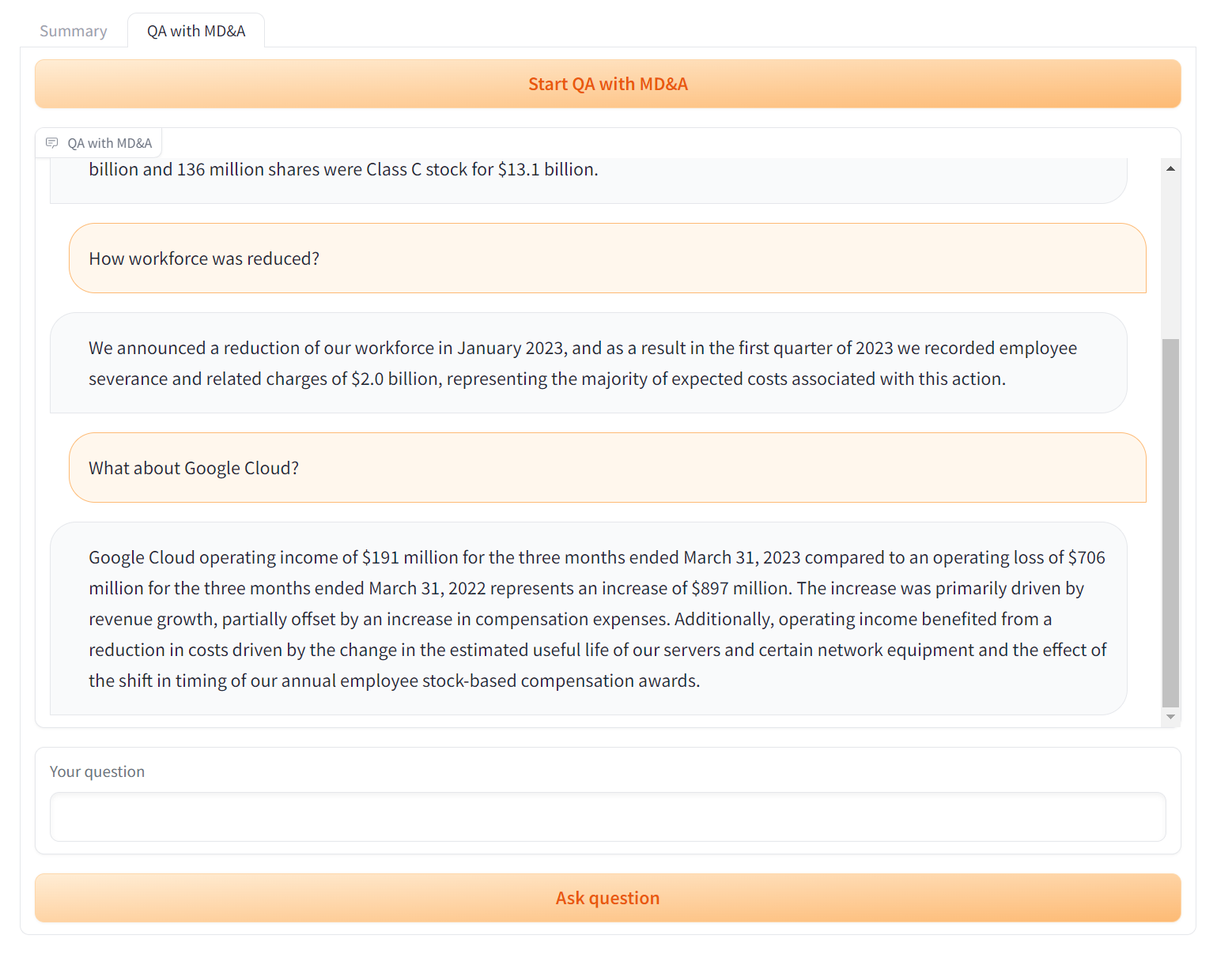

Q: Describe share repurchase.

A: Share repurchase is a program authorized by the Board of Directors of Alphabet in April 2022 and April 2023 to repurchase up to $140.0 billion of its Class A and Class C shares. As of March 31, 2023, $13.1 billion remains available for Class A and Class C share repurchases. During the three months ended March 31, 2023, Alphabet repurchased and subsequently retired 157 million shares for $15.1 billion. Of the aggregate amount repurchased and subsequently retired, 21 million shares were Class A stock for $2.0 billion and 136 million shares were Class C stock for $13.1 billion.

Q: How workforce was reduced?

A: We announced a reduction of our workforce in January 2023, and as a result in the first quarter of 2023 we recorded employee severance and related charges of $2.0 billion, representing the majority of expected costs associated with this action.

Q: What about Google Cloud?

A: Google Cloud operating income of $191 million for the three months ended March 31, 2023 compared to an operating loss of $706 million for the three months ended March 31, 2022 represents an increase of $897 million. The increase was primarily driven by revenue growth, partially offset by an increase in compensation expenses. Additionally, operating income benefited from a reduction in costs driven by the change in the estimated useful life of our servers and certain network equipment and the effect of the shift in timing of our annual employee stock-based compensation awards.

Thank you for reading!